Colombia In A World Of Geoeconomic Fragmentation

As the world's major powers attempt to bolster their spheres of influence, the global economy is becoming increasingly fragmented. How will this situation play out, especially for Colombia and other developing nations?

Heading 2

Paragraph

Heading 3

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

Heading 4

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Heading 5

Less than a decade ago, the concepts of globalization and geoeconomic integration seemed totally inevitable. Trade barriers were things of the past, and protecting domestic industries was seen as a problem for consumers, not governments. Economic nationalism was a belief supposedly destined to disappear.

How quickly things change. Nowadays, the majority of international organizations recognize the existence of a growing geoeconomic fragmentation, and major powers are increasingly prioritizing their own security over free markets.

Despite the best attempts of corporations and multinational organizations to curtail it, geoeconomic fragmentation remains a growing phenomenon. Armed conflicts, cyber warfare, and economic nationalism are part of a future that is already here. In this article, we’ll examine the events that brought us to this point and assess some of the winners and losers of this transformation.

International Trade: Not What It Used To Be

Some of the ideas that laid the foundation for the international order after the fall of the Berlin Wall were free markets and increasing international trade. For many years, the United States and Europe championed these two pillars as a way to engage with the world - or at least that was the case until 2008. Since then, global trade has constituted a decreasing proportion of countries' GDPs. Paradoxically, it is China that is currently seeking to enhance international trade liberalization and reduce trade barriers.

Regarding other countries, international trade and its current negotiations are based on blocs that trade with each other according to different international political stances or proximity-based factors. For instance, the European Union as a collective prioritizes itself, and many countries within the bloc reject increasing trade with Mercosur (Brazil-Argentina) and other blocs in order to protect their own interests.

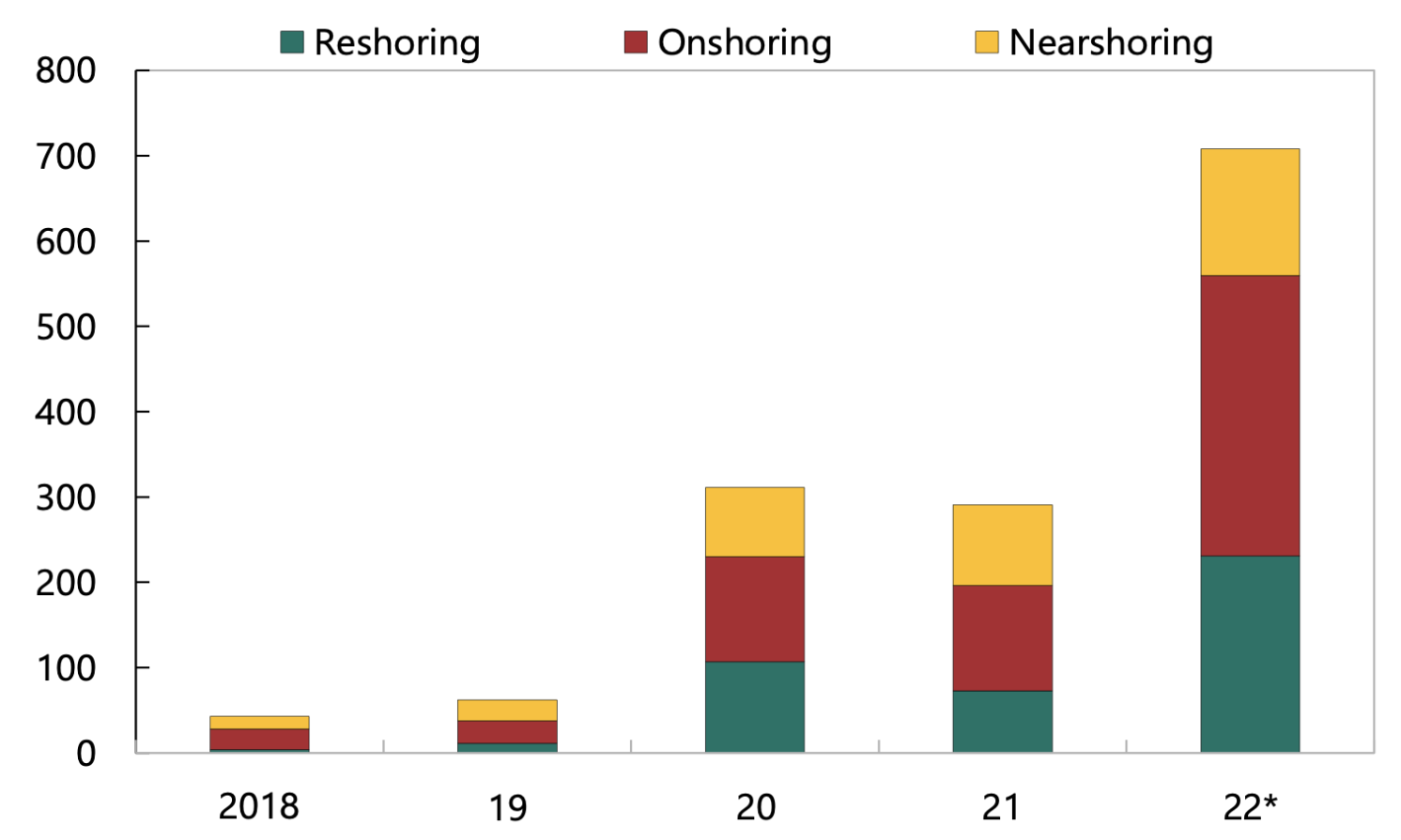

The COVID-19 pandemic also underscored the dependence of many Western countries on trade with China, particularly for essential goods or inputs crucial for national security. Since then, the agendas of the United States and Europe have focused on a gradual ‘decoupling’ from the Chinese economy, now perceived as an increasing economic threat. Additionally, Russia has become an increasingly direct security threat to Western countries. A direct result is that reshoring, onshoring, and nearshoring are booming. Countries are seeking to be more independent from others that don’t share their views.

American Hegemony Under Strain

Geoeconomic fragmentation can also be understood as a consequence of China's rise. In this scenario, most nations acknowledge the absence of a singular dominant power. While the United States boasts the world's most formidable military, China is gaining the upper hand in a trade-driven global landscape. Consequently, Western nations, particularly the United States, are attempting to concentrate their efforts on managing their alliances and trading more selectively with allies. As a result, the world is heading towards fragmentation into areas of economic and cultural influence.

China's admittance into the World Trade Organization (WTO) in 2001 represented a turning point in the global influence exerted by the Asian nation. Since then, China has leveraged its expansive market size to forge stronger diplomatic ties with the international community. This strategy has given rise to the establishment of "spheres of influence," wherein China positions itself as a purchaser of raw materials, and the Chinese Communist Party, facilitated by state-owned enterprises, puts money into local infrastructure through credit arrangements.

This approach is encapsulated by the Belt and Road Initiative, which has been signed by 155 countries so far. In brief, China assumes the role of both investor and purchaser for partner countries, subsequently offering them significant infrastructure development and receiving money for its ongoing maintenance.

War And Its Consequences

One of the major outcomes arising from the conflict between Russia and Ukraine is the economic division between Europe and Russia. Before the war, Russia used to supply around 40% of the EU's imported gas, but currently, that proportion has dwindled to less than 10%. To counter the shortage, the European Union ramped up its imports from the United States, solidifying and defining an area of geoeconomic fragmentation.

Conversely, Russia has boosted its oil & gas exports to growing neutral nations like India, which is also a member of the BRICS (Brazil-Russia-India-China-South Africa) coalition. This bloc is shaping up as an emerging alternative economic pole and has recently surpassed the combined GDP of the G7 countries.

The conflict between Ukraine and Russia also highlighted that Russia's influence zone in the Caucasus and Eastern Europe is tacitly acknowledged by China, which has been keeping its distance and staying neutral throughout the war. Despite Zelenskyy's appeals to Xi Jinping to utilize its market influence to help end the war, Xi has refrained from agreeing to a meeting since the conflict began.

BRICS countries are currently in talks about expanding the bloc, at the summit scheduled from August 22 to 24. South African officials have mentioned that more than 40 countries have shown interest in joining BRICS. However, only Argentina has received a green light from the bloc to join, and this will not necessarily happen now. Apart from the discussion on enlargement, another item on the summit's agenda is to enhance the use of member states' local currencies in trade and financial transactions. This move aims to reduce dependence on the U.S. dollar.

"The process of de-dollarization in our economic connections is an objective and irreversible trend that is gaining momentum," stated Russia's Putin at the summit, signaling a desire to continue the process of geoeconomic fragmentation.

There is one obvious question left: who are the winners and losers of this new, geofragmented world we are entering?

Winners And Losers

A hasty response might suggest that China or the BRICS countries are the beneficiaries of fragmentation, but the truth is that contenders rarely gain from either military or economic conflicts. The Western response of reshoring production and labor can potentially curtail the growth of China and other Asian countries, however, the escalating conflicts in the Pacific Ocean involving Japan and Taiwan also demand increased military expenditures, heightening long-term risks for all involved nations.

The true beneficiaries of geoeconomic fragmentation are neutral countries that can gain advantages from contenders seeking allies. For instance, Latin American countries are courted by both China and the United States for investments, credit, and business development. Another crucial aspect is institutional stability and government credibility, which foster the inflow of foreign capital. As a result, these countries could potentially foster ties with more than one economic bloc.

In this regard, the most significant Latin American economies are Brazil, Argentina, and Colombia. However, Brazil and Argentina show signs of incompatibility in terms of benefiting in the medium term.

Regarding Brazil, President Lula Da Silva has shown a growing interest in "de-dollarizing" the country and favoring trade with China through the use of the Yuan and possibly creating a currency with BRICS. The effects of these types of policies are usually not positive for asset price expectations and might be worse for Brazil's currency, the Brazilian real.

In addition, both of Brazil’s most important frontmen in politics have been in jail or banned from participating in elections, Lula Da Silva and Jair Bolsonaro, which contributes to a continuous state of “revenge” in institutional and political terms.

Argentina’s case is clearer, its economy is among the most volatile on the continent, with more than 115% annual inflation. The country has capital controls in place, which restrict the inflow and outflow of dollars. Moreover, its foreign exchange market is "broken" as the official government exchange rate does not accurately represent the real value of the local currency, the Argentine peso. Not to mention that by joining BRICS, Argentina would be moving away from the U.S. sphere of influence and towards rival powers like Russia and China.

However, one Latin American nation that finds itself firmly allied with the United States is Colombia. With wide-reaching free trade agreements, close proximity in terms of logistics, and access to both Atlantic and Pacific sea lanes, Colombia is a country that naturally suits the role of foremost U.S. ally in Latin America. In fact, Colombia is already benefitting greatly from this expanded relationship, adding new foreign direct investment and no shortage of expats and tourists pouring money into the country.

Only time will tell how this emerging geofragmented world will evolve. But clearly, the tendency towards fragmentation will continue. As the world's major powers compete for allies and resources, countries like Colombia will benefit from especially strong ties to the world's leading superpower, the United States - a situation that is unlikely to change any time soon.

Gain insider access to Farmfolio's network.

Receive weekly insights and updates directly from Farmfolio.